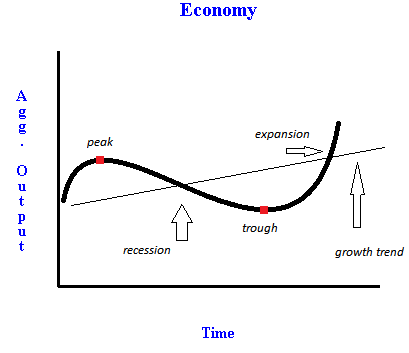

The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions.

The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions.

They appear to substitute between debt and fairness instruments as Jermann and Quadrini (2012) demonstrated for the aggregate firm. However, by the start of the 20th century, economists and policymakers had begun recognizing an industrial enterprise cycle.

Absent financial frictions, but in the presence of a debt tax benefit, firms make investments more and tend to be financed totally with debt. Traders could possibly use the business cycle to revenue from the market by choosing the proper stocks on the proper time.

The housing market has typically been an essential driver of U.S. business cycles and its recovery is nowhere near complete. Within the Keynesian tradition, Richard Goodwin 29 accounts for cycles in output by the distribution of income between enterprise earnings and staff’ wages.

We analyze this mechanism in a heterogeneous agency model with endogenous agency dynamics that we match to the usual pattern of public U.S. firms utilizing Compustat knowledge. Armed with the model, we quantitatively discover how firm dimension interacts with investment and financial frictions to generate the cross-sectional variations in cyclical-financing behavior.