The business cycle, also called the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) round its lengthy-time period development trend. In line with Statistics Netherlands’ Enterprise Cycle Tracer, the financial state of affairs in March 2019 is again considerably much less favourable than in the previous month. Our definition of equity financing captures exactly what we wish: the trade-offs behind firms’ determination to finance investments with external funds.

The business cycle, also called the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) round its lengthy-time period development trend. In line with Statistics Netherlands’ Enterprise Cycle Tracer, the financial state of affairs in March 2019 is again considerably much less favourable than in the previous month. Our definition of equity financing captures exactly what we wish: the trade-offs behind firms’ determination to finance investments with external funds.

31 He additionally presumes that economic cycles with completely different periodicity will be compared to the merchandise with various life-cycles. Measure business cycles from peak to peak. The business-cycle correlations of fairness payout within the nonfriction case display procyclical payout patterns for small corporations, that’s, all firms behave like massive firms.

Subsequently, small companies challenge more (much less) fairness in booms (recessions). To this finish, we make use of the identical regression analysis on a mannequin-generated panel as we did with the info panel. Over the current growth, residential funding’s share of nominal GDP has elevated steadily, however from a very low stage following the Nice Recession.

Within the mannequin with excessive frictions, we set the equity issuance value parameter 10 instances higher $(\lambda=2)$ and the fraction lost in default to 1 (â $\varepsilon=1$â ). Interest rates, in flip, are an important determinant of how a lot companies and shoppers want to spend.

When inflation and recession happen concurrently – a phenomenon usually known as stagflation – it is troublesome to know which financial policy to use. These results lead us to conclude that monetary frictions are necessary for explaining the cross-sectional variations in the financing habits of companies over the enterprise cycle.…

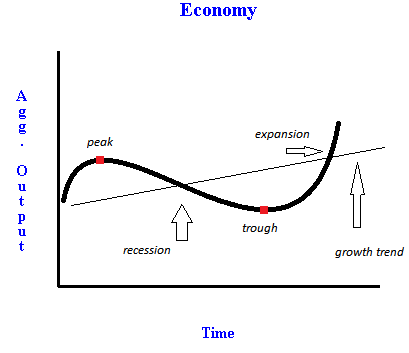

The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions.

The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions. Our ninth convention on Development and Business Cycle in Idea and Apply, 5-6 July 2018. We analyze this mechanism in a heterogeneous firm mannequin with endogenous agency dynamics that we match to the standard sample of public U.S. firms utilizing Compustat data. Armed with the mannequin, we quantitatively discover how agency size interacts with funding and monetary frictions to generate the cross-sectional differences in cyclical-financing conduct.

Our ninth convention on Development and Business Cycle in Idea and Apply, 5-6 July 2018. We analyze this mechanism in a heterogeneous firm mannequin with endogenous agency dynamics that we match to the standard sample of public U.S. firms utilizing Compustat data. Armed with the mannequin, we quantitatively discover how agency size interacts with funding and monetary frictions to generate the cross-sectional differences in cyclical-financing conduct.