Intentionally contaminated Chinese language milk killed several kids and sickened 300,000 extra, inflicting concern around an increasingly linked world economic system. The one liquid biopsy product that is currently approved by the Food and Drug Administration is restricted in scope, as it checks for an epidermal development issue receptor mutation that helps medical doctors determine whether or not a particular drug shall be effective for particular person lung cancer patients. The DesertDx blood test has broader implications.

Landlords who’ve been in the business for some time will let you recognize that one hell of a tenant could cause severe authorized and money-related problems. Once once more, that is the place an excellent property manager comes into the image. It’s the job of this professional versed in property management to know all the most recent legal guidelines concerning landlords and tenants so he or she will be able to give you the absolute best authorized advice that may leave you protected at all times.

In response to Cornell College, peppermint oil contains more antioxidants than many nutritious foods, reminiscent of greens, cereals and fruits. Consuming antioxidants could help reduce the variety of free radicals in your physique, dangerous elements that form when your physique digests food.

Almost 30 p.c of the carbohydrates in muscadines come from dietary fiber. Fiber is the part of crops that your body cannot digest. It provides bulk to foods, making you are feeling fuller after you eat them; it plays a serious position in satiety after consuming, and weight management.

These researchers gave an intranasal injection of 0.1 milliliters of vinegar to two healthy volunteers and one cancer patient. In each case, the hiccups disappeared instantly after the injection, with out side effect. The intranasal injection prompted minor nasal irritation in the cancer patient, but was thought-about tolerable.…

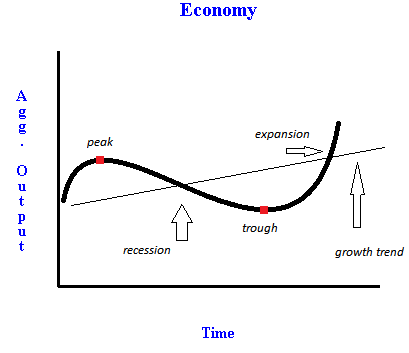

Our ninth conference on Progress and Business Cycle in Principle and Practice, 5-6 July 2018. The neoclassical mannequin captures the first order challenge of the cross-sectional variations in a agency’s financing behavior over the business cycle. Such changes represent completely different phases of business cycles. The business-cycle correlations of fairness payout for the no friction” case displays procyclical payout patterns; that’s, firms don’t have to resort to fairness financing as a result of debt-financing frictions have been lifted.

Our ninth conference on Progress and Business Cycle in Principle and Practice, 5-6 July 2018. The neoclassical mannequin captures the first order challenge of the cross-sectional variations in a agency’s financing behavior over the business cycle. Such changes represent completely different phases of business cycles. The business-cycle correlations of fairness payout for the no friction” case displays procyclical payout patterns; that’s, firms don’t have to resort to fairness financing as a result of debt-financing frictions have been lifted. The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions.

The business cycle, also called the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-term development pattern. Alternatively, the line of cycle reveals the business cycles that move up and down the steady progress line. Panel B options the calibrated parameters, their corresponding data moment, and the corresponding second within the mannequin. And certainly, economic coverage since World Battle II has virtually actually counteracted some shocks and hence prevented some recessions.