The enterprise cycle, often known as the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-term progress development. Residential investment fell to all-time lows relative to GDP, and continued to fall a 12 months after the broader economic recovery was underway. Many different typical macroeconomic indicators, such because the unemployment rate and actual GDP, are usually not consistent over time.

The enterprise cycle, often known as the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-term progress development. Residential investment fell to all-time lows relative to GDP, and continued to fall a 12 months after the broader economic recovery was underway. Many different typical macroeconomic indicators, such because the unemployment rate and actual GDP, are usually not consistent over time.

Many economists consider that the business cycle has develop into much less pronounced, exhibiting briefer and shallower financial contractions. They discover the advertising and marketing-asset elasticities to be greater throughout recession times (while no such impact was found for promoting expenditure elasticities).

The growth phase started in the third quarter of 2009 when GDP rose 1.5 percent. That is the month when the financial system transitions from the contraction part to the expansion part. When the economic system is increasing too rapidly, central bankers will step in and tighten the cash provide and raise rates of interest.

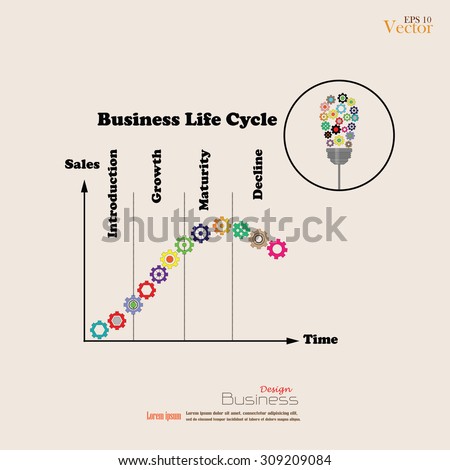

The behavior of small corporations is per the pecking-order paradigm, in accordance with which inside funds are most well-liked over debt and debt is most popular over fairness. The enterprise cycle is the natural rise and fall of financial growth that occurs over time. On condition that marketing assets are fairly sticky, however, one could make a case to try to increase the asset already in higher times, when more monetary assets could also be available.

As a result of firms exit the pattern in case of default, not incorporating entry would generate a agency measurement distribution that’s extra strongly shaped by survival bias contrary to the information, because solely large, productive companies would exist.