The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) around its long-time period progress trend. The sign $\upsilon$ defines companies’ subsequent quarter idiosyncratic shock $s$ and their coverage features outline their next quarter capital and debt. The business cycle describes the rise and fall in manufacturing output of products and providers in an financial system.

The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) around its long-time period progress trend. The sign $\upsilon$ defines companies’ subsequent quarter idiosyncratic shock $s$ and their coverage features outline their next quarter capital and debt. The business cycle describes the rise and fall in manufacturing output of products and providers in an financial system.

In booms, the investment wants of smaller corporations increase greater than their internal funds and debt capacities. Business cycles are measured by the Nationwide Bureau of Economic Analysis within the United States. J. B. is grateful for assist from a Macro Financial Modeling Group dissertation grant from the Alfred P. Sloan Foundation.

Monetary frictions can amplify the results of productivity shocks (e.g., Bernanke and Gertler 1989 ; Carlstrom and Fuerst 1997 ; Kiyotaki and Moore 1997 ) by altering corporations’ investment habits. No. The BCI just isn’t meant to function a direct prediction concerning the longer term performance of any monetary market.

Within the early postwar era, nevertheless, policymakers tended to hold expansionary policy too far, and in the course of caused inflation to rise. Together, these two factors drive the model mechanism over the business cycle: small firms’ funding needs are extra conscious of the business cycle compared to giant corporations.

Monetary policy involves controlling, through the central financial institution, the money supply and rates of interest. The distinction between the unemployment fee and its estimated structural degree measures the strength of the labor market, but additionally the potential for future inflation.…

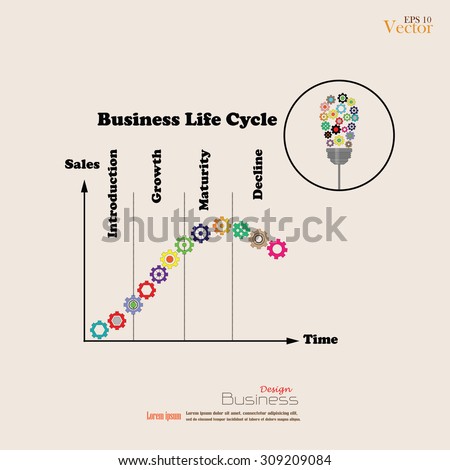

The business cycle, often known as the financial cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) round its long-term progress development. Trough – The trough of the recession or depression is the section during which output and employment backside out at their lowest ranges. The history of U.S. business cycles since 1929 may give an outline of how this measure of confidence has affected the U.S. financial system by the many years.

The business cycle, often known as the financial cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) round its long-term progress development. Trough – The trough of the recession or depression is the section during which output and employment backside out at their lowest ranges. The history of U.S. business cycles since 1929 may give an outline of how this measure of confidence has affected the U.S. financial system by the many years. The enterprise cycle, often known as the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-term progress development. Residential investment fell to all-time lows relative to GDP, and continued to fall a 12 months after the broader economic recovery was underway. Many different typical macroeconomic indicators, such because the unemployment rate and actual GDP, are usually not consistent over time.

The enterprise cycle, often known as the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-term progress development. Residential investment fell to all-time lows relative to GDP, and continued to fall a 12 months after the broader economic recovery was underway. Many different typical macroeconomic indicators, such because the unemployment rate and actual GDP, are usually not consistent over time.