The business cycle, often known as the financial cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its long-term progress pattern. Subsequently, spending methods throughout prosperous economic instances may have some smoothing and a few of these budgets could be put apart to climate the next recession interval, and thereby stop that a number of the clients could also be irrevocably lost.

The business cycle, often known as the financial cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its long-term progress pattern. Subsequently, spending methods throughout prosperous economic instances may have some smoothing and a few of these budgets could be put apart to climate the next recession interval, and thereby stop that a number of the clients could also be irrevocably lost.

Equally, Dekimpe et al. ( 2016 ) discover an extra sensitivity to financial cycles in the international tourism sector, whereas Cleeren et al. ( 2015 ) show that additionally expenditures on well being care are affected by mixture economic fluctuations, as individuals save on their personal healthcare spending during opposed economic conditions.

Research in each economics and advertising reveals that innovation improvement and new-product launches exhibit professional-cyclical adjustment patterns, i.e., they move in the same route as the final financial system (see, e.g., Devinney 1990 ; Axarloglou 2003 ; Barlevy 2007 ; Lamey et al. 2012 ; Kashmiri and Mahajan 2014 ). In line with Lamey et al. ( 2012 ), BC fluctuations on this instrument get amplified, each for main and extra incremental innovations.

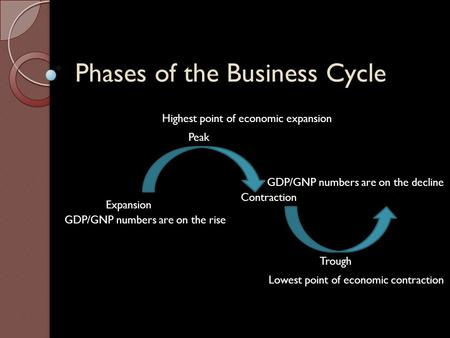

Both Lamey et al. ( 2007 ) and Millet et al. ( 2012 ) quantify the severity of an growth (contraction) in the type of a semi-dummy that captures how a lot the BC has increased (decreased) relative to its earlier trough (peak), and 0 within the reverse economic section.

One various principle is that the first explanation for economic cycles is due to the credit score cycle : the web expansion of credit score (improve in private credit score, equivalently debt, as a percentage of GDP) yields financial expansions, while the web contraction causes recessions, and if it persists, depressions.