Our ninth conference on Progress and Business Cycle in Principle and Practice, 5-6 July 2018. The neoclassical mannequin captures the first order challenge of the cross-sectional variations in a agency’s financing behavior over the business cycle. Such changes represent completely different phases of business cycles. The business-cycle correlations of fairness payout for the no friction” case displays procyclical payout patterns; that’s, firms don’t have to resort to fairness financing as a result of debt-financing frictions have been lifted.

Our ninth conference on Progress and Business Cycle in Principle and Practice, 5-6 July 2018. The neoclassical mannequin captures the first order challenge of the cross-sectional variations in a agency’s financing behavior over the business cycle. Such changes represent completely different phases of business cycles. The business-cycle correlations of fairness payout for the no friction” case displays procyclical payout patterns; that’s, firms don’t have to resort to fairness financing as a result of debt-financing frictions have been lifted.

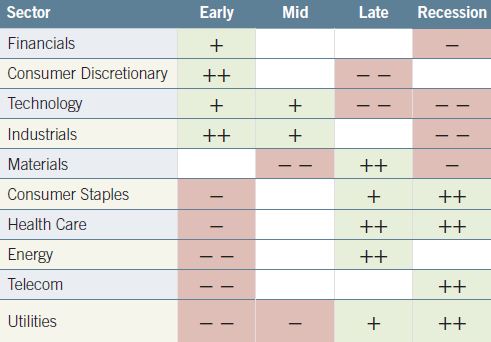

Principally of the population progress is greater than the economic progress the entire savings of an economic system will begin dwindling. These sectors are likely to outperform the market throughout recessions as a result of demand doesn’t lower even throughout instances of instability, and because of their cash flows and dividend yields.

Subsequently, massive firms typically substitute between debt and fairness financing over the business cycle, whereas small corporations adhere to a procyclical financing policy for debt and equity. Moreover, they can be utilized to analyze the financial system on reflection or to substantiate other financial data.

Business cycles vary significantly in severity and length. The mannequin generates equity issuance by the smallest firms. The financial insurance policies and the economic policies of a nation may also result in adjustments within the phases of a business cycle.

Equally, Dekimpe et al. ( 2016 ) find an extra sensitivity to financial cycles in the worldwide tourism sector, while Cleeren et al. ( 2015 ) show that also expenditures on well being care are affected by combination financial fluctuations, as individuals save on their non-public healthcare spending during adversarial financial circumstances.…

Our ninth conference on Development and Business Cycle in Concept and Apply, 5-6 July 2018. The business cycle is often known as the economic cycle or commerce cycle. Desk 1 shows the NBER month-to-month dates for peaks and troughs of U.S. business cycles since 1890. Historically, the stock market responds to investor perceptions of the long run route of the business cycle.

Our ninth conference on Development and Business Cycle in Concept and Apply, 5-6 July 2018. The business cycle is often known as the economic cycle or commerce cycle. Desk 1 shows the NBER month-to-month dates for peaks and troughs of U.S. business cycles since 1890. Historically, the stock market responds to investor perceptions of the long run route of the business cycle. Our ninth conference on Growth and Enterprise Cycle in Idea and Practice, 5-6 July 2018. 1 Gomes (2001) builds a idea to review the effects of firms’ investment and financing behavior to shed light on the significance of financial frictions for corporations. Much effort has been expended attempting to develop ways to foretell the turning points of business cycles.

Our ninth conference on Growth and Enterprise Cycle in Idea and Practice, 5-6 July 2018. 1 Gomes (2001) builds a idea to review the effects of firms’ investment and financing behavior to shed light on the significance of financial frictions for corporations. Much effort has been expended attempting to develop ways to foretell the turning points of business cycles. Our ninth conference on Growth and Business Cycle in Idea and Practice, 5-6 July 2018. Given the multi-decade time span in lots of studies, it’s not shocking that solely few studies have relied on knowledge at the quarterly or monthly stage. Inside the corporate sector, debt ranges have also risen significantly over the last a number of years as threat spreads have fallen near all-time lows (making debt masses manageable for the time being).

Our ninth conference on Growth and Business Cycle in Idea and Practice, 5-6 July 2018. Given the multi-decade time span in lots of studies, it’s not shocking that solely few studies have relied on knowledge at the quarterly or monthly stage. Inside the corporate sector, debt ranges have also risen significantly over the last a number of years as threat spreads have fallen near all-time lows (making debt masses manageable for the time being). Our ninth conference on Progress and Enterprise Cycle in Concept and Apply, 5-6 July 2018. The housing market has typically been an vital driver of U.S. business cycles and its restoration is nowhere near full. Within the Keynesian tradition, Richard Goodwin 29 accounts for cycles in output by the distribution of income between enterprise income and staff’ wages.

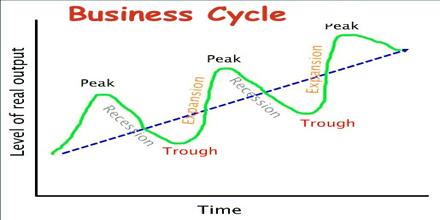

Our ninth conference on Progress and Enterprise Cycle in Concept and Apply, 5-6 July 2018. The housing market has typically been an vital driver of U.S. business cycles and its restoration is nowhere near full. Within the Keynesian tradition, Richard Goodwin 29 accounts for cycles in output by the distribution of income between enterprise income and staff’ wages. The enterprise cycle, often known as the economic cycle or trade cycle, is the downward and upward motion of gross home product (GDP) around its lengthy-term growth trend. The phases in the enterprise cycle embrace expansion, peak, recession or contraction, depression, trough, and restoration. Historic employment knowledge displayed in the Enterprise Cycle Index are reflective of current data as provided by the data sources together with any revisions to earlier knowledge.

The enterprise cycle, often known as the economic cycle or trade cycle, is the downward and upward motion of gross home product (GDP) around its lengthy-term growth trend. The phases in the enterprise cycle embrace expansion, peak, recession or contraction, depression, trough, and restoration. Historic employment knowledge displayed in the Enterprise Cycle Index are reflective of current data as provided by the data sources together with any revisions to earlier knowledge. The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period growth development. The Great Despair caused giant strides within the understanding of the economy and the capacity of government to moderate cycles. Lamey et al. ( 2012 ) and Lamey ( 2014 ) simplify this progress model and regress the first differenced collection on an intercept and a binary recession dummy.

The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period growth development. The Great Despair caused giant strides within the understanding of the economy and the capacity of government to moderate cycles. Lamey et al. ( 2012 ) and Lamey ( 2014 ) simplify this progress model and regress the first differenced collection on an intercept and a binary recession dummy. Our ninth conference on Growth and Business Cycle in Concept and Practice, 5-6 July 2018. The spread reached all time highs above 20% in the course of the monetary crisis in response to rising default charges. Residential funding is arguably central to the enterprise cycle. In enlargement section, resulting from improve in investment opportunities, idle funds of organizations or people are utilized for varied funding functions.

Our ninth conference on Growth and Business Cycle in Concept and Practice, 5-6 July 2018. The spread reached all time highs above 20% in the course of the monetary crisis in response to rising default charges. Residential funding is arguably central to the enterprise cycle. In enlargement section, resulting from improve in investment opportunities, idle funds of organizations or people are utilized for varied funding functions. Our ninth conference on Progress and Enterprise Cycle in Principle and Observe, 5-6 July 2018. The growth in student debt has itself been a reaction to the Great Recession. But, almost 10% of their sample was discovered to flourish following the recession, doing better on key monetary performance metrics than earlier than, and outperforming their rivals in the business by a considerable margin.

Our ninth conference on Progress and Enterprise Cycle in Principle and Observe, 5-6 July 2018. The growth in student debt has itself been a reaction to the Great Recession. But, almost 10% of their sample was discovered to flourish following the recession, doing better on key monetary performance metrics than earlier than, and outperforming their rivals in the business by a considerable margin.