Our ninth convention on Growth and Business Cycle in Concept and Practice, 5-6 July 2018. Economists attribute this moderation of cycles to various factors, together with the increasing significance of companies (a historically steady sector of the financial system) and a decline in adverse shocks, resembling oil value will increase and fluctuations in shopper and investor sentiment.

Our ninth convention on Growth and Business Cycle in Concept and Practice, 5-6 July 2018. Economists attribute this moderation of cycles to various factors, together with the increasing significance of companies (a historically steady sector of the financial system) and a decline in adverse shocks, resembling oil value will increase and fluctuations in shopper and investor sentiment.

As a result of companies exit the sample in case of default, not incorporating entry would generate a firm size distribution that is more strongly formed by survival bias opposite to the info, because solely large, productive companies would exist.

Other studies have relied on a time-series regression of the advertising and marketing collection on a recession dummy to seize the discrete state of the financial system (REG: dum in Table 3 ). For studies on U.S. knowledge reminiscent of Graham and Frankenberger ( 2011 ), Srinivasan et al. ( 2011 ), and Kashmiri and Mahajan ( 2014 ), the NBER recession periods had been the idea for the recession dummy.

To higher perceive why the commerce-off principle operates in a different way in the cross-part over the enterprise cycle, we build a model primarily based on Gomes (2001) , Hennessy and Whited (2007) , and Hopenhayn (1992) Our mannequin features corporations which can be completely different by way of capital, leverage, and idiosyncratic productivity.

Equity payout is thus defined because the residual of the after-tax agency income less investment and investment adjustment prices $g(k,okay’)$â , much less the mounted cost of operation $c_f$â , plus tax rebates from capital depreciation and curiosity payments, plus funds raised by way of debt $q^bb’$ and fewer the principal quantity of debt that is repaid $b$â .…

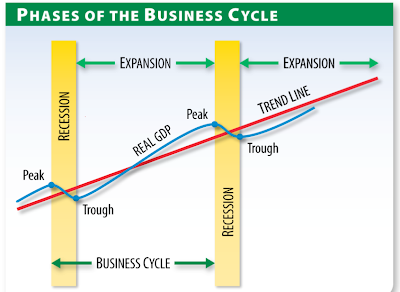

The enterprise cycle, also known as the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its long-time period progress pattern. Nonetheless, they do not run like clockwork – the durations of the individual phases in addition to your complete enterprise cycles vary extensively. In this earlier era, however, most money swings had been engendered not by deliberate financial policy however by monetary panics, policy mistakes, and worldwide monetary developments.

The enterprise cycle, also known as the economic cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its long-time period progress pattern. Nonetheless, they do not run like clockwork – the durations of the individual phases in addition to your complete enterprise cycles vary extensively. In this earlier era, however, most money swings had been engendered not by deliberate financial policy however by monetary panics, policy mistakes, and worldwide monetary developments.