If you want to arrange your tax assertion successfully, you need to look into the high profile providers provided by specialists. The info from both surveys is lined up to create what’s formally referred to as the Employment Situation Summary, or jobs report, which supplies the most accurate image on the present state of employment and, consequently, the present state of the economic system.

Ultimately, a funds forecast is solely taking your Revenue, then subtracting your Value of Items Sold (COGS) and your monthly Bills to get your EBITDA (earnings before interest, taxes, depreciation, and amortization). Unless you’re working a reasonably financially sophisticated enterprise the impact of curiosity, depreciation, and amortization should not have an excessive amount of of an effect on your backside line, so your EBITDA should come pretty near forecasting your precise profit, aside from taxes (your CPA needs to be supplying you with course on forecasting those).

However nonetheless, there is already a foot-lengthy list of overdue federal coverage modifications that would no less than start to fortify our future and reknit the safety internet. Even amid the awfulness of our political moment, we will start to construct a platform to rally around. Raise the minimum wage and tie it to inflation. Roll again anti-union laws to offer employees more leverage towards companies that deal with them as if they’re disposable. Tilt the tax code away from the rich. Right now, rich folks can write off mortgage interest on their second residence and expenses related to being a landlord or (I am not kidding) owning a racehorse. The rest of us cannot even deduct scholar loans or the price of getting an occupational license.

Since the Nice Recession, the nice†jobs—secure, non-temp, first rate wage—have concentrated in cities like by no means before. America’s one hundred largest metros have added 6 million jobs since the downturn. Rural areas, in the meantime, nonetheless have fewer jobs than they did in 2007. For young people looking for work, transferring to a major metropolis will not be an indulgence. It’s a virtual necessity.

The panic attacks are gone now. After an excruciating two-year job hunt, throughout which he had to beg pals to provide him an opportunity, Mike finally found a position on the fringes of the finance business. It does not pay as well as his previous one, but it surely’s sufficient.…

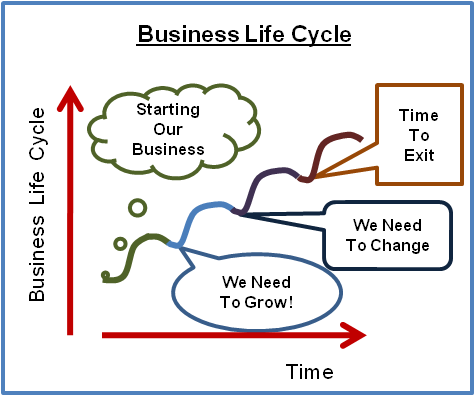

The business cycle, also called the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its long-time period progress development. Our mechanism produces the following predictions: (1) fairness payout is growing in measurement; (2) leverage is growing in size; (three) payout throughout booms is increasing in dimension and profitability; (four) small, unprofitable corporations improve equity financing throughout booms; (5) giant, profitable corporations pay out during booms; and (6) all firms finance more with debt during booms.

The business cycle, also called the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its long-time period progress development. Our mechanism produces the following predictions: (1) fairness payout is growing in measurement; (2) leverage is growing in size; (three) payout throughout booms is increasing in dimension and profitability; (four) small, unprofitable corporations improve equity financing throughout booms; (5) giant, profitable corporations pay out during booms; and (6) all firms finance more with debt during booms. The mission of the Business and Finance Division is to help Georgia Southern University’s pursuit of academic distinction in instructing, scholarship, and repair in a pupil-centered surroundings by providing management over the business and financial operations and physical property of the University. The first year of the BA (Hons) Enterprise and Finance supplies a possibility to experience all features of enterprise and personal finance, earlier than selecting a higher level of specialisation in the later years of the course. Located close to downtown Atlanta, Emory University Goizueta Business Faculty ‘s BBA programme is presently ranked No. 15 by each Bloomberg BusinessWeek and U.S. Information & World Report.

The mission of the Business and Finance Division is to help Georgia Southern University’s pursuit of academic distinction in instructing, scholarship, and repair in a pupil-centered surroundings by providing management over the business and financial operations and physical property of the University. The first year of the BA (Hons) Enterprise and Finance supplies a possibility to experience all features of enterprise and personal finance, earlier than selecting a higher level of specialisation in the later years of the course. Located close to downtown Atlanta, Emory University Goizueta Business Faculty ‘s BBA programme is presently ranked No. 15 by each Bloomberg BusinessWeek and U.S. Information & World Report. A business diploma is a strong, profession-launching qualification, and when you’re fascinated by a career in enterprise, combining two subjects offers you sought-after skills, exciting experiences and a whole world of future career opportunities. The module aims to show students to problem and think into the longer term, while guaranteeing the vision has a agency monetary and programs foundation. The purpose of this module is to offer the scholar with an understanding of analysis principles, a spread of quantitative and qualitative research methodologies and applicable evaluation for these.

A business diploma is a strong, profession-launching qualification, and when you’re fascinated by a career in enterprise, combining two subjects offers you sought-after skills, exciting experiences and a whole world of future career opportunities. The module aims to show students to problem and think into the longer term, while guaranteeing the vision has a agency monetary and programs foundation. The purpose of this module is to offer the scholar with an understanding of analysis principles, a spread of quantitative and qualitative research methodologies and applicable evaluation for these. The enterprise cycle, also called the economic cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-term progress development. This is consistent with the fact that giant corporations payout fairness in booms and repurchase debt in recessions. Enterprise cycles do happen, nonetheless, because disturbances to the economy of one sort or another push the economy above or under full employment.

The enterprise cycle, also called the economic cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-term progress development. This is consistent with the fact that giant corporations payout fairness in booms and repurchase debt in recessions. Enterprise cycles do happen, nonetheless, because disturbances to the economy of one sort or another push the economy above or under full employment. Our ninth convention on Development and Business Cycle in Idea and Apply, 5-6 July 2018. We analyze this mechanism in a heterogeneous firm mannequin with endogenous agency dynamics that we match to the standard sample of public U.S. firms utilizing Compustat data. Armed with the mannequin, we quantitatively discover how agency size interacts with funding and monetary frictions to generate the cross-sectional differences in cyclical-financing conduct.

Our ninth convention on Development and Business Cycle in Idea and Apply, 5-6 July 2018. We analyze this mechanism in a heterogeneous firm mannequin with endogenous agency dynamics that we match to the standard sample of public U.S. firms utilizing Compustat data. Armed with the mannequin, we quantitatively discover how agency size interacts with funding and monetary frictions to generate the cross-sectional differences in cyclical-financing conduct.