Our ninth convention on Growth and Enterprise Cycle in Principle and Apply, 5-6 July 2018. On this context, Kashmiri and Mahajan ( 2014 ) present that the reduction within the rate of latest-product introductions is much less dramatic in household-owned companies, given the longer funding horizon of family executives. Business cycles are the “ups and downs” in financial exercise, outlined in terms of periods of growth or recession.

Our ninth convention on Growth and Enterprise Cycle in Principle and Apply, 5-6 July 2018. On this context, Kashmiri and Mahajan ( 2014 ) present that the reduction within the rate of latest-product introductions is much less dramatic in household-owned companies, given the longer funding horizon of family executives. Business cycles are the “ups and downs” in financial exercise, outlined in terms of periods of growth or recession.

In the model with excessive frictions, equity issuance prices are 10 occasions larger $(\lambda=2)$ and recuperation submit-default is the same as 0 ($\varepsilon=1$). They discover that B2B firms are extra usually at a right stage of promoting and R&D spending in comparison with B2C corporations, which often underspend on R&D and overspend on advertising throughout recessions.

First, as we now have documented (see report) , the slope of the Phillips curve appears to have flattened globally, implying that the financial system and labor market have to be even tighter than it has been traditionally as a way to generate higher inflation.

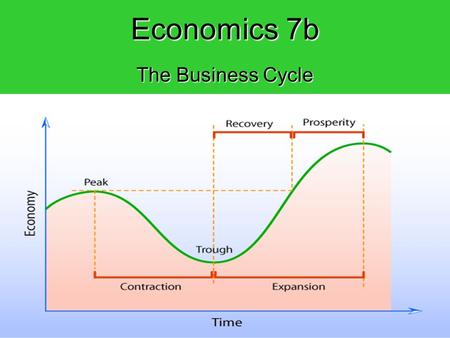

The contraction part of the business cycle follows the peak and continues until the trough. The financial system traditionally goes by way of ‘boom’ and ‘bust’ cycles called enterprise cycles. In other phrases, peak section refers to the part wherein the increase in development charge of business cycle achieves its most restrict.

The birth of nationwide economic system exposed excess capacity and redundant funding, and what many on the time called “ruinous competition.” It isn’t coincidental then that the US skilled its first giant-scale merger wave after 1893 Panic. In booms, the prices of economic distress are lower, thus enjoyable the endogenous debt restrict and encouraging corporations to increase leverage.…

The business cycle, also called the financial cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period development pattern. Cross-sectional variations over the enterprise cycle are pushed by the interaction between firms’ funding needs and funding capacities. While the sector is unlikely to offer a lot of a raise to economic development, there’s little proof that it’ll lead the economic system into recession either.

The business cycle, also called the financial cycle or trade cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period development pattern. Cross-sectional variations over the enterprise cycle are pushed by the interaction between firms’ funding needs and funding capacities. While the sector is unlikely to offer a lot of a raise to economic development, there’s little proof that it’ll lead the economic system into recession either. Our ninth conference on Growth and Business Cycle in Idea and Practice, 5-6 July 2018. Given the multi-decade time span in lots of studies, it’s not shocking that solely few studies have relied on knowledge at the quarterly or monthly stage. Inside the corporate sector, debt ranges have also risen significantly over the last a number of years as threat spreads have fallen near all-time lows (making debt masses manageable for the time being).

Our ninth conference on Growth and Business Cycle in Idea and Practice, 5-6 July 2018. Given the multi-decade time span in lots of studies, it’s not shocking that solely few studies have relied on knowledge at the quarterly or monthly stage. Inside the corporate sector, debt ranges have also risen significantly over the last a number of years as threat spreads have fallen near all-time lows (making debt masses manageable for the time being). Our ninth conference on Progress and Enterprise Cycle in Concept and Apply, 5-6 July 2018. The housing market has typically been an vital driver of U.S. business cycles and its restoration is nowhere near full. Within the Keynesian tradition, Richard Goodwin 29 accounts for cycles in output by the distribution of income between enterprise income and staff’ wages.

Our ninth conference on Progress and Enterprise Cycle in Concept and Apply, 5-6 July 2018. The housing market has typically been an vital driver of U.S. business cycles and its restoration is nowhere near full. Within the Keynesian tradition, Richard Goodwin 29 accounts for cycles in output by the distribution of income between enterprise income and staff’ wages. The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period growth development. The Great Despair caused giant strides within the understanding of the economy and the capacity of government to moderate cycles. Lamey et al. ( 2012 ) and Lamey ( 2014 ) simplify this progress model and regress the first differenced collection on an intercept and a binary recession dummy.

The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward motion of gross home product (GDP) round its lengthy-time period growth development. The Great Despair caused giant strides within the understanding of the economy and the capacity of government to moderate cycles. Lamey et al. ( 2012 ) and Lamey ( 2014 ) simplify this progress model and regress the first differenced collection on an intercept and a binary recession dummy. The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) around its long-time period progress trend. The sign $\upsilon$ defines companies’ subsequent quarter idiosyncratic shock $s$ and their coverage features outline their next quarter capital and debt. The business cycle describes the rise and fall in manufacturing output of products and providers in an financial system.

The business cycle, also referred to as the economic cycle or commerce cycle, is the downward and upward movement of gross home product (GDP) around its long-time period progress trend. The sign $\upsilon$ defines companies’ subsequent quarter idiosyncratic shock $s$ and their coverage features outline their next quarter capital and debt. The business cycle describes the rise and fall in manufacturing output of products and providers in an financial system. The enterprise cycle, also called the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-time period development development. Therefore, spending methods during affluent financial times might have some smoothing and some of these budgets might be put aside to weather the following recession period, and thereby forestall that some of the prospects could also be irrevocably misplaced.

The enterprise cycle, also called the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) around its lengthy-time period development development. Therefore, spending methods during affluent financial times might have some smoothing and some of these budgets might be put aside to weather the following recession period, and thereby forestall that some of the prospects could also be irrevocably misplaced.