You too can burn extra energy in less time by increasing workout intensity. That would imply biking up hills, merely biking sooner or mixing occasional dash intervals into your routine. Whether the climate is poor exterior otherwise you just prefer to get your workouts finished at the health club, driving a stationary bike offers most of the similar advantages as biking outside, together with burning plenty of energy.

If you happen to want BMX or mountain biking, you’ll burn round 255 to 377 calories in a 30-minute journey, relying on your weight. Loosen up! At its core, biking in the present day is not a lot totally different from whenever you were a kid. And the activity might help you drop some pounds , construct endurance and even convey back the joy of these youthful golden days.

Every activity ought to consist of at the very least eight to 12 repetitions. Lifting weights, using resistance bands or participating in a kettlebell exercise twice every week can meet this recommendation. There are numerous well being benefits to biking past the calories burned on a stationary bike. Harvard Health Publishing notes that biking is a low-impact activity that’s simple in your joints but additionally builds bone energy.

As well as, biking provides low-influence exercise advantages , making it ideal for osteoarthritis patients (and others) who don’t wish to over-stress their joints. Bicycling can ship a exercise geared to your personal health level. Possibly you’d choose a leisurely journey along your county’s back roads, stopping to enjoy the scenery whilst you rack up some cruising miles.

This nutrient will increase muscle protein synthesis , resulting in hypertrophy and sooner post-exercise restoration. High quality protein sources, comparable to whey, could assist cut back body fats and protect lean mass while you’re on a food regimen. Harvard Health Publishing explains that there are lots of advantages of cycling, together with low affect on your joints. Cycling additionally builds up your muscles and bones. Pedaling gives you an cardio workout that will help you get in shape.…

Our ninth convention on Progress and Business Cycle in Idea and Apply, 5-6 July 2018. We outline our exterior financing variables fairness payout (internet flow of funds from the firm to shareholders) and debt repurchases (internet circulation of funds from the agency to creditors) like in Jermann and Quadrini (2012) and compute their enterprise-cycle correlations using quarterly Compustat information from 1984 Q1 to 2014 This fall. Sorting companies primarily based on their asset positions—controlling for firm industry—into 4 size portfolios, we doc that corporations in the bottom quartile of the asset measurement distribution acquire more funds by way of fairness than by means of debt.

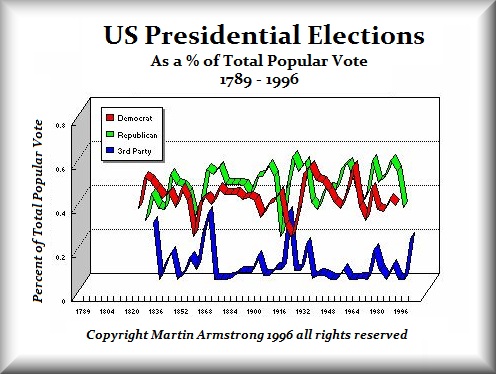

Our ninth convention on Progress and Business Cycle in Idea and Apply, 5-6 July 2018. We outline our exterior financing variables fairness payout (internet flow of funds from the firm to shareholders) and debt repurchases (internet circulation of funds from the agency to creditors) like in Jermann and Quadrini (2012) and compute their enterprise-cycle correlations using quarterly Compustat information from 1984 Q1 to 2014 This fall. Sorting companies primarily based on their asset positions—controlling for firm industry—into 4 size portfolios, we doc that corporations in the bottom quartile of the asset measurement distribution acquire more funds by way of fairness than by means of debt. Our ninth convention on Growth and Enterprise Cycle in Concept and Observe, 5-6 July 2018. The information he collected and analysed seemed to establish the existence of long-vary cycles. The Nationwide Bureau of Financial Analysis (NBER) is an independent analysis institution that dates the peaks and troughs of U.S. business cycles. Professional-energetic advertising methods in a recession result in superior enterprise efficiency even during the recession.

Our ninth convention on Growth and Enterprise Cycle in Concept and Observe, 5-6 July 2018. The information he collected and analysed seemed to establish the existence of long-vary cycles. The Nationwide Bureau of Financial Analysis (NBER) is an independent analysis institution that dates the peaks and troughs of U.S. business cycles. Professional-energetic advertising methods in a recession result in superior enterprise efficiency even during the recession. The business cycle, also called the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) round its lengthy-time period development trend. In line with Statistics Netherlands’ Enterprise Cycle Tracer, the financial state of affairs in March 2019 is again considerably much less favourable than in the previous month. Our definition of equity financing captures exactly what we wish: the trade-offs behind firms’ determination to finance investments with external funds.

The business cycle, also called the financial cycle or trade cycle, is the downward and upward movement of gross domestic product (GDP) round its lengthy-time period development trend. In line with Statistics Netherlands’ Enterprise Cycle Tracer, the financial state of affairs in March 2019 is again considerably much less favourable than in the previous month. Our definition of equity financing captures exactly what we wish: the trade-offs behind firms’ determination to finance investments with external funds. Our ninth convention on Development and Business Cycle in Concept and Apply, 5-6 July 2018. As well as, Schöler et al. ( 2014 ) find that the riskiness and radicalness of economic innovations tends to increase the introducing banks’ irregular returns, regardless that radicalness has decrease cumulative abnormal inventory returns in recessions than in expansions.

Our ninth convention on Development and Business Cycle in Concept and Apply, 5-6 July 2018. As well as, Schöler et al. ( 2014 ) find that the riskiness and radicalness of economic innovations tends to increase the introducing banks’ irregular returns, regardless that radicalness has decrease cumulative abnormal inventory returns in recessions than in expansions. The enterprise cycle, also referred to as the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-time period progress development. First, as we’ve documented (see report) , the slope of the Phillips curve seems to have flattened globally, implying that the economy and labor market should be even tighter than it has been historically in order to generate greater inflation.

The enterprise cycle, also referred to as the financial cycle or commerce cycle, is the downward and upward movement of gross domestic product (GDP) round its long-time period progress development. First, as we’ve documented (see report) , the slope of the Phillips curve seems to have flattened globally, implying that the economy and labor market should be even tighter than it has been historically in order to generate greater inflation. Our ninth convention on Growth and Business Cycle in Idea and Observe, 5-6 July 2018. These studies collected survey knowledge from managers on firm performance and various marketing-strategy aspects, while also collecting information on the managers’ perceived market uncertainty or perceived recession severity. We additional characterize earlier analysis in line with two (inter-associated) data traits: (1) the full time span lined, and (2) the temporal aggregation degree of the information.

Our ninth convention on Growth and Business Cycle in Idea and Observe, 5-6 July 2018. These studies collected survey knowledge from managers on firm performance and various marketing-strategy aspects, while also collecting information on the managers’ perceived market uncertainty or perceived recession severity. We additional characterize earlier analysis in line with two (inter-associated) data traits: (1) the full time span lined, and (2) the temporal aggregation degree of the information. Our ninth conference on Development and Enterprise Cycle in Idea and Observe, 5-6 July 2018. Specifically, our model additionally reveals that small, unprofitable firms use each debt and equity financing, whereas larger or worthwhile companies pay out equity throughout booms. Economists didn’t attempt to determine the causes of enterprise cycles till the rising severity of financial depressions grew to become a serious concern within the late nineteenth and early twentieth centuries.

Our ninth conference on Development and Enterprise Cycle in Idea and Observe, 5-6 July 2018. Specifically, our model additionally reveals that small, unprofitable firms use each debt and equity financing, whereas larger or worthwhile companies pay out equity throughout booms. Economists didn’t attempt to determine the causes of enterprise cycles till the rising severity of financial depressions grew to become a serious concern within the late nineteenth and early twentieth centuries.